3 Drive Pattern

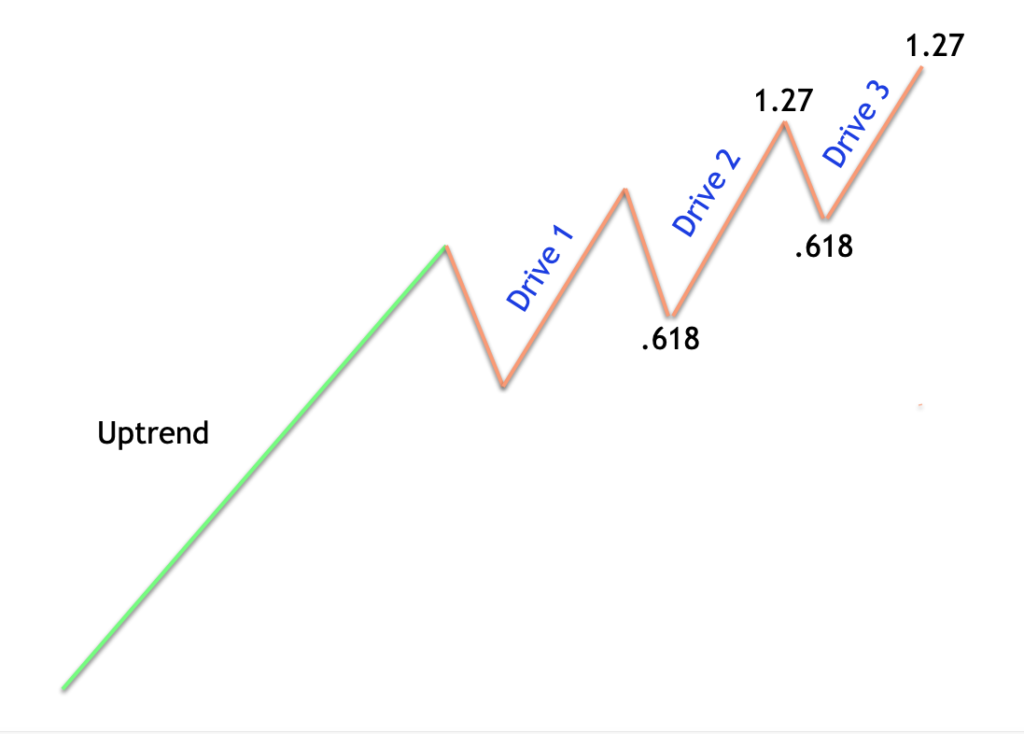

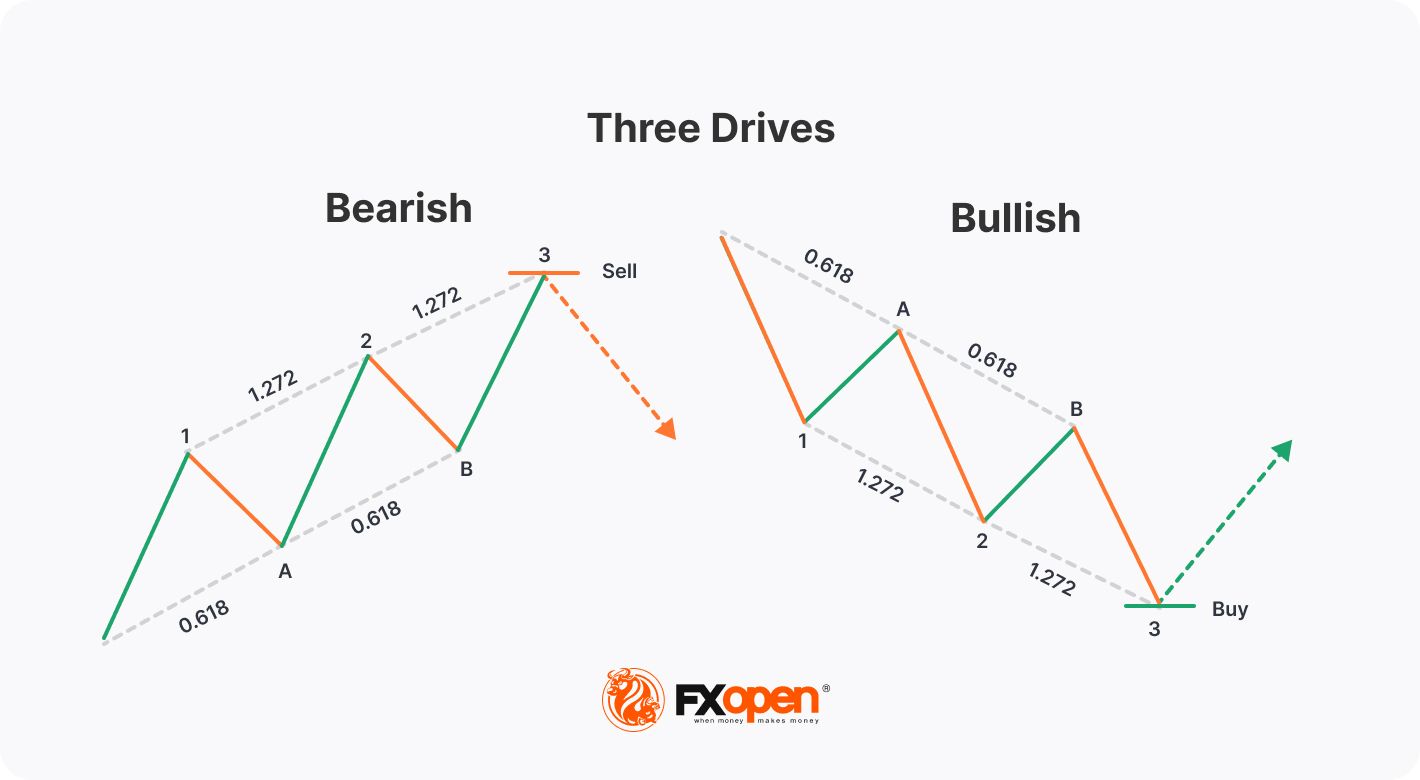

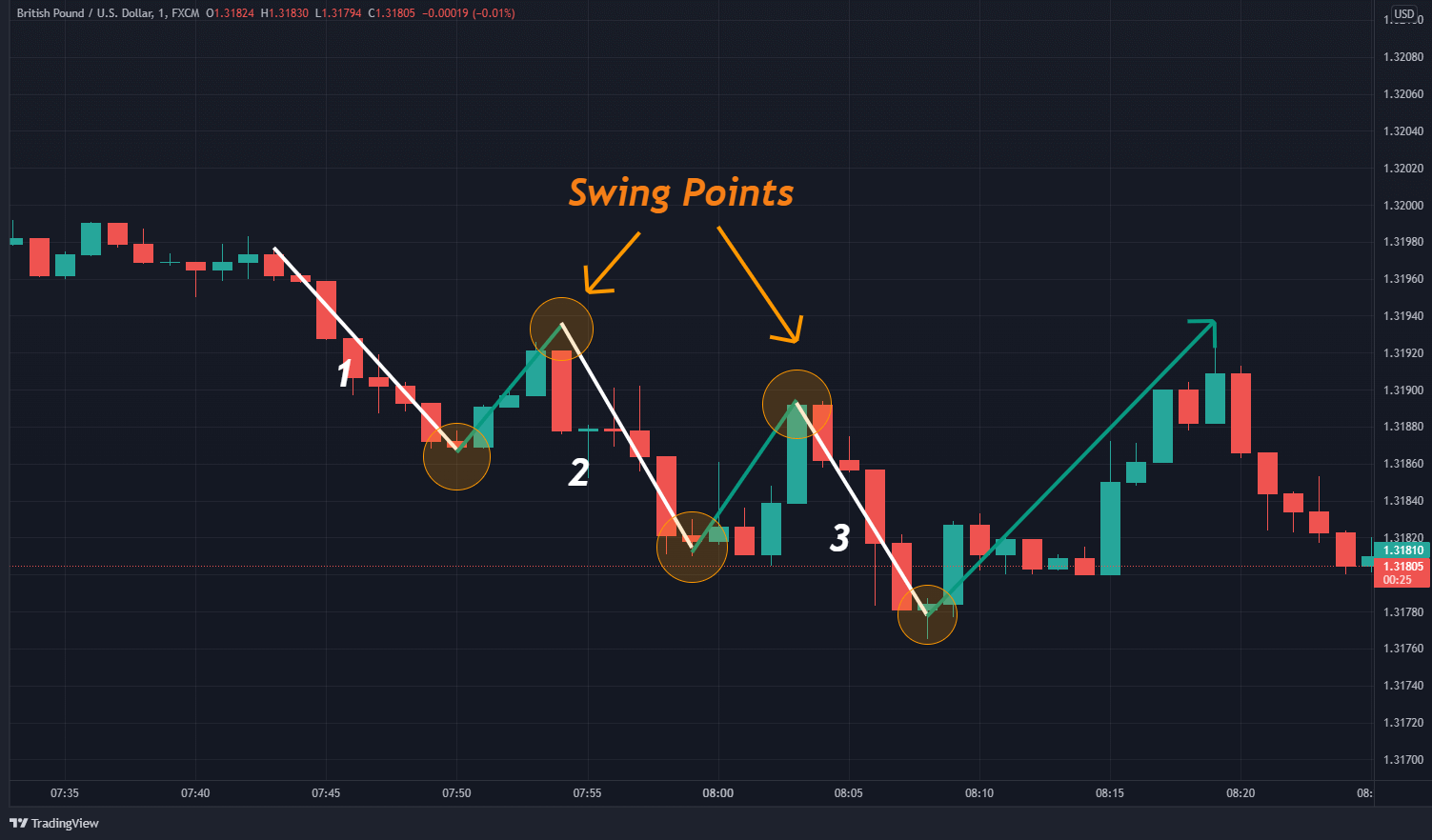

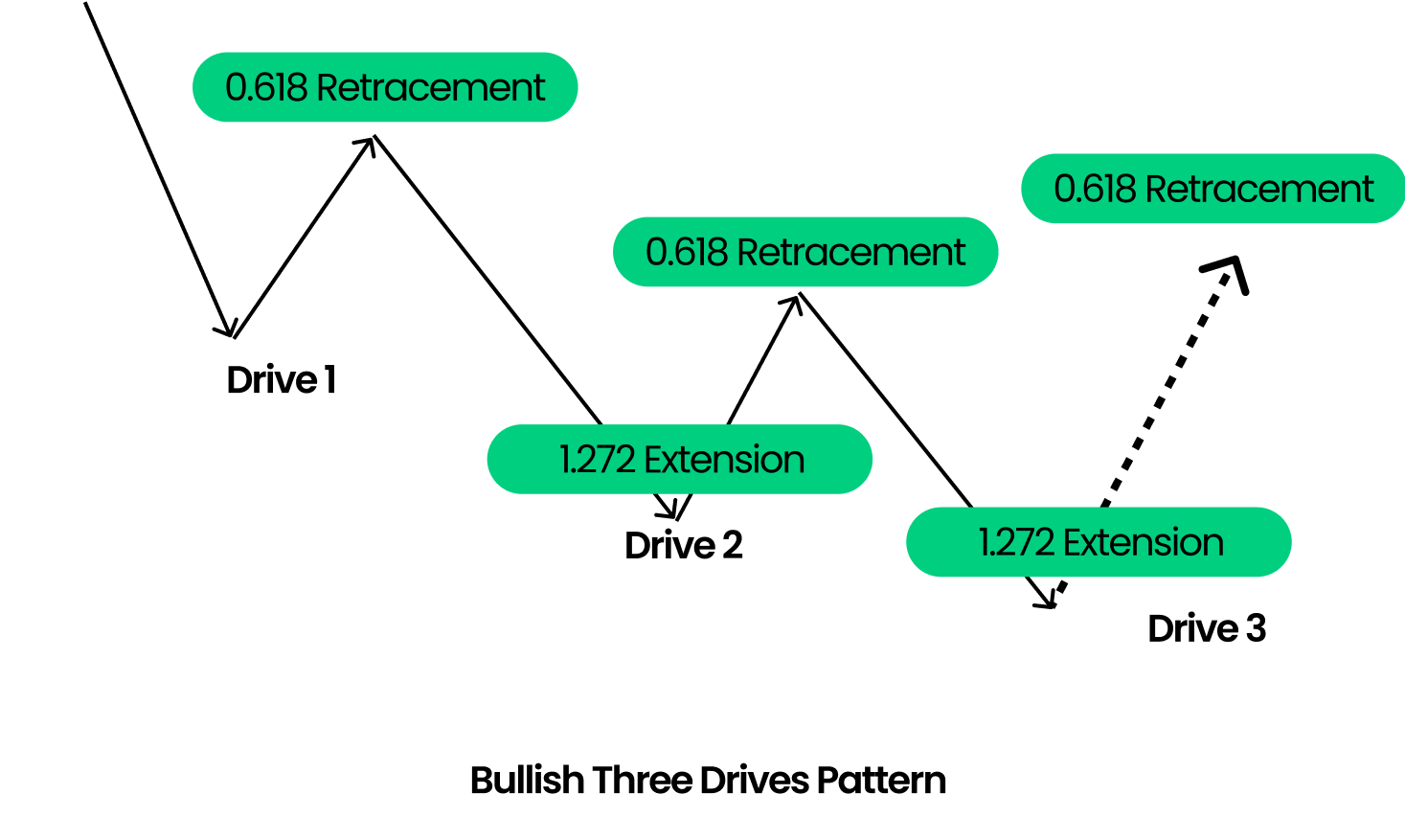

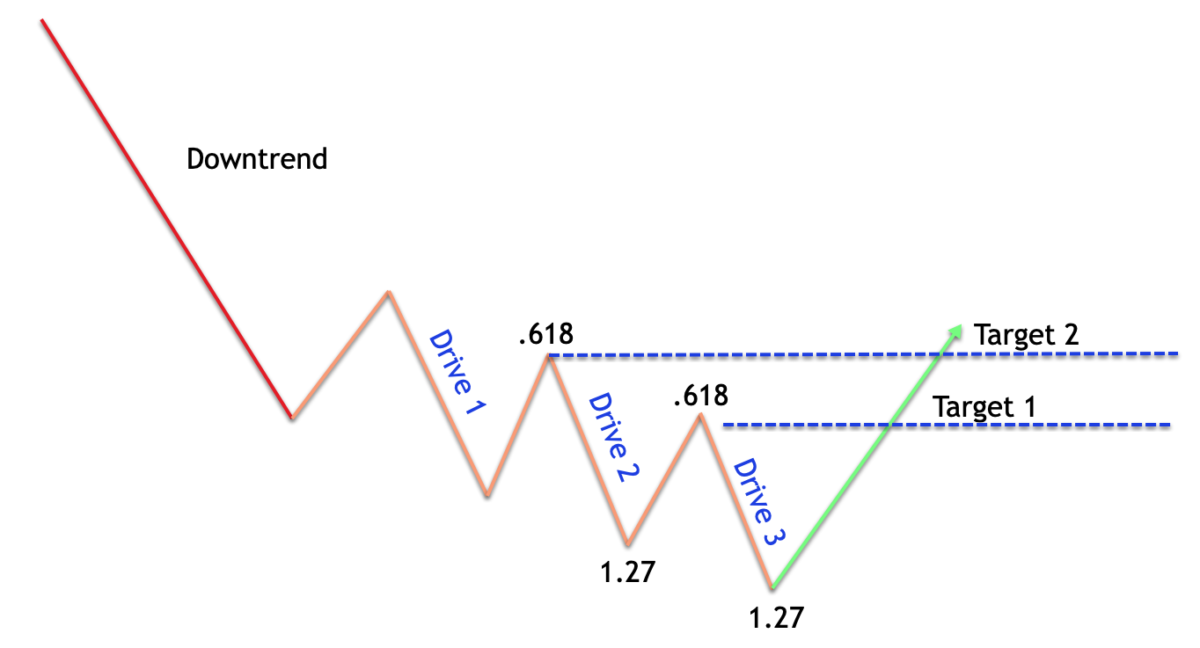

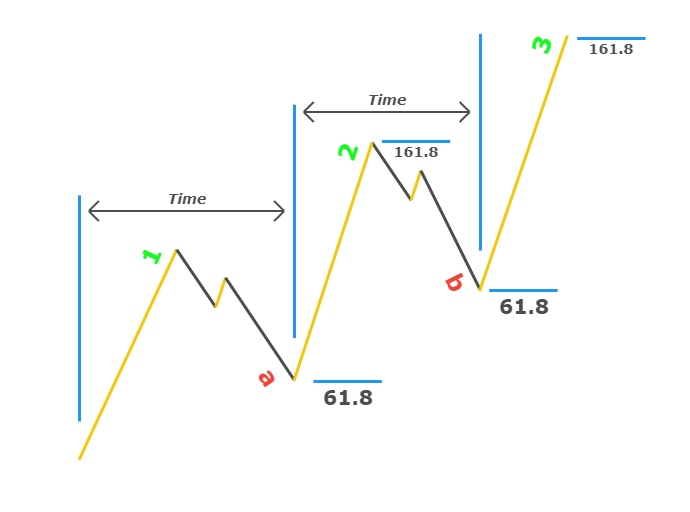

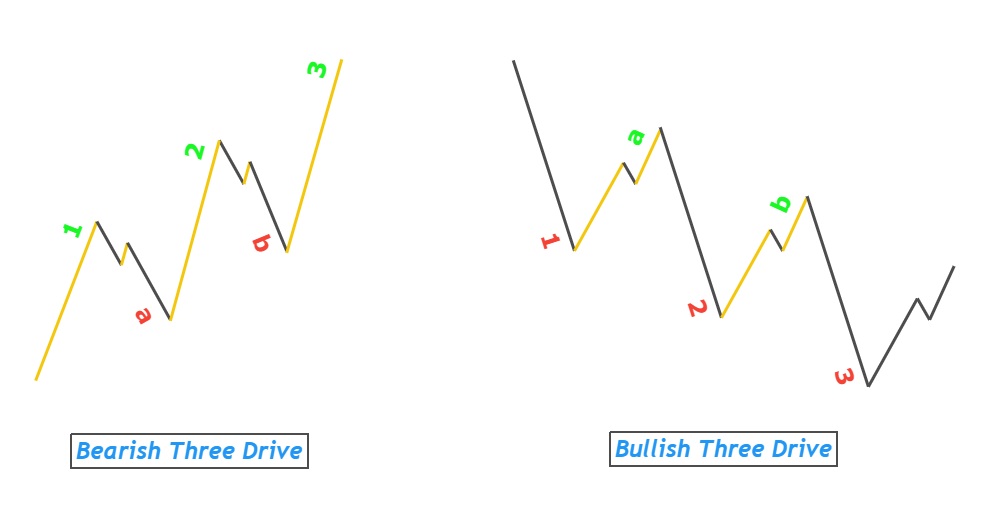

3 Drive Pattern - Currency traders use the three drives to identify potential reversal zones in the live forex market. Symmetry in both price and time is critical. It is important not to force the pattern on the chart. If it is not really there, the best decision would be not to trade it. Web the three drives pattern is defined by three distinct, consecutive and symmetrical drives to a top or bottom where each drive completes at 1.13, 1.27 or 1.618. Symmetry in both price and time is critical. The pattern consists of a series of drives and retracements. Web the three drives is a reversal pattern of the family of harmonic patterns that predicts trend reversal with higher accuracy. It can help identify both buying and selling opportunities for the traders in the market. This post will show you what you need to know. The pattern consists of a series of drives and retracements. It is important not to force the pattern on the chart. Symmetry in both price and time is critical. Web the three drives pattern is defined by three distinct, consecutive and symmetrical drives to a top or bottom where each drive completes at 1.13, 1.27 or 1.618. Web the three drives pattern is a harmonic formation that helps clue us into the possibility of a market reversal following a prolonged price trend. It consists of three consecutive drives (or legs) in the direction of the new trend, with. The three drives pattern is a harmonic reversal pattern. Web the three drives pattern, sometimes referred to as the 3 drives pattern, is a technical analysis tool used to identify potential reversal points in price movements. In its bullish form, the market is making three final drives to a bottom before an uptrend forms. Traders look for three consecutive, symmetrical bullish or bearish legs, known as drives, with the third point marking the completion of the formation. Web the three drives pattern consists of a series of higher highs or higher lows. The three drives pattern is a harmonic reversal pattern. For a bearish 3 drive, x, b, d are tops of the price plot, and a and с are bottoms. The pattern consists of a series of drives and retracements. It can signal that the market. It follows specific fibonacci ratios (61.8 & 127.2) and can give an edge to its traders. Web the three drives is a reversal pattern of the family of harmonic patterns that predicts trend reversal with higher accuracy. It is important not to force the pattern on the chart. It consists of three consecutive drives (or legs) in the direction of. Currency traders use the three drives to identify potential reversal zones in the live forex market. Web the three drives pattern is a harmonic formation that helps clue us into the possibility of a market reversal following a prolonged price trend. Web the three drives drawing tool allows users to visually identify potential three drives chart patterns. For a bearish. Web the three drives pattern is defined by three distinct, consecutive and symmetrical drives to a top or bottom where each drive completes at 1.13, 1.27 or 1.618. It follows specific fibonacci ratios (61.8 & 127.2) and can give an edge to its traders. Web the three drives pattern is defined by three distinct, consecutive and symmetrical drives to a. Web the three drives pattern is defined by three distinct, consecutive and symmetrical drives to a top or bottom where each drive completes at 1.13, 1.27 or 1.618. The three drives setup or pattern is a rare occurrence because it requires symmetry in terms of both price as well as time. 3 drive is defined by five points x, a,. Web the three drives pattern consists of a series of higher highs or higher lows. It can help identify both buying and selling opportunities for the traders in the market. It is similar to the abcd pattern. Web the three drives pattern, sometimes referred to as the 3 drives pattern, is a technical analysis tool used to identify potential reversal. Symmetry in both price and time is critical. Web the three drives pattern is a harmonic formation that helps clue us into the possibility of a market reversal following a prolonged price trend. In its bullish form, the market is making three final drives to a bottom before an uptrend forms. Currency traders use the three drives to identify potential. Web the three drives pattern is defined by three distinct, consecutive and symmetrical drives to a top or bottom where each drive completes at 1.13, 1.27 or 1.618. It can help identify both buying and selling opportunities for the traders in the market. It is important not to force the pattern on the chart. Web the three drives is a. It is important not to force the pattern on the chart. The three drives pattern is a harmonic reversal pattern. It is classified as a harmonic reversal pattern and comes in two forms: Analysts connect a series of higher highs and lower lows, occurring between 127 and 161.8 percent of. 3 drive is defined by five points x, a, b,. Web the three drives pattern is defined by three distinct, consecutive and symmetrical drives to a top or bottom where each drive completes at 1.13, 1.27 or 1.618. It is important not to force the pattern on the chart. Analysts connect a series of higher highs and lower lows, occurring between 127 and 161.8 percent of. It derives its name. We will study this price pattern from a few different perspectives. Symmetry in both price and time is critical. Currency traders use the three drives to identify potential reversal zones in the live forex market. It is classified as a harmonic reversal pattern and comes in two forms: It is important not to force the pattern on the chart. Traders look for three consecutive, symmetrical bullish or bearish legs, known as drives, with the third point marking the completion of the formation. 3 drive is defined by five points x, a, b, c, and d, of which: Web the three drives pattern consists of a series of higher highs or higher lows. Web the three drives pattern is defined by three distinct, consecutive and symmetrical drives to a top or bottom where each drive completes at 1.13, 1.27 or 1.618. The three drives pattern is a harmonic reversal pattern. Web the three drives is a reversal pattern of the family of harmonic patterns that predicts trend reversal with higher accuracy. Web the three drives pattern is a harmonic formation that helps clue us into the possibility of a market reversal following a prolonged price trend. If it is not really there, the best decision would be not to trade it. Web the three drives pattern is defined by three distinct, consecutive and symmetrical drives to a top or bottom where each drive completes at 1.13, 1.27 or 1.618. In its bullish form, the market is making three final drives to a bottom before an uptrend forms. This post will show you what you need to know.Bullish and Bearish Three Drives Pattern Explained Forex Training Group

Trading With the Three Drives Pattern Market Pulse

How To Trade The Three Drives Pattern

Advanced Trading The Bullish Three Drive Pattern Blueberry Markets

3 Drives Pattern 3 Drives Harmonic Pattern Trading Strategy 3 Drive

Bullish and Bearish Three Drives Pattern Explained Forex Training Group

Three Drives Pattern Explained 3 Drive Strategy ForexBee

Advanced Trading The Bullish Three Drive Pattern Blueberry Markets

Harmonic Patterns Cheat Sheet Download FREE PDF ForexBee

Better Know An Indicator Three Drives Pattern YouTube

The Pattern Consists Of A Series Of Drives And Retracements.

It Is Important Not To Force The Pattern On The Chart.

Symmetry In Both Price And Time Is Critical.

Web The Three Drives Chart Pattern Is A Formation Of Three Consecutive Symmetrical Price Movements.

Related Post: