Bearish Candlestick Patterns

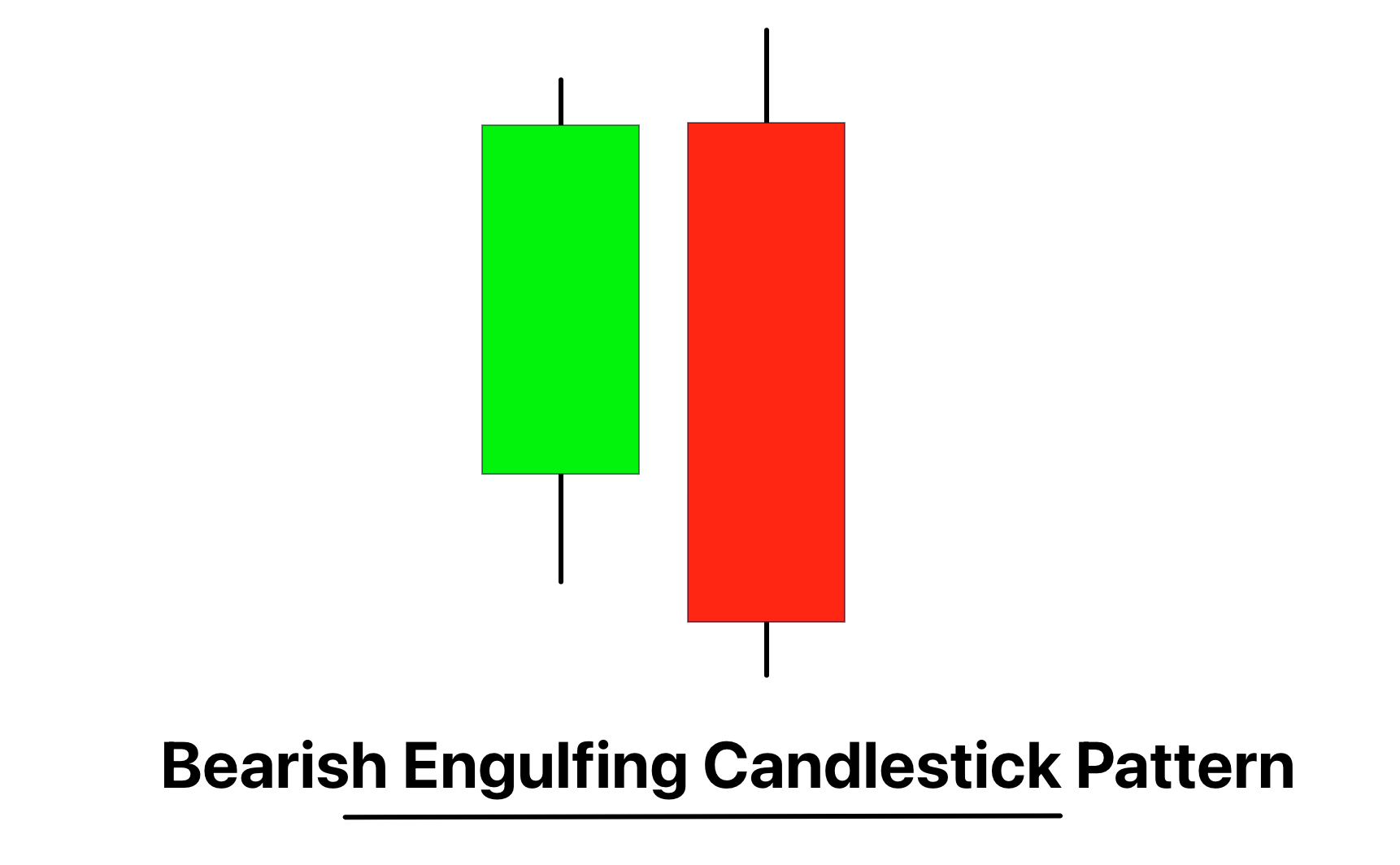

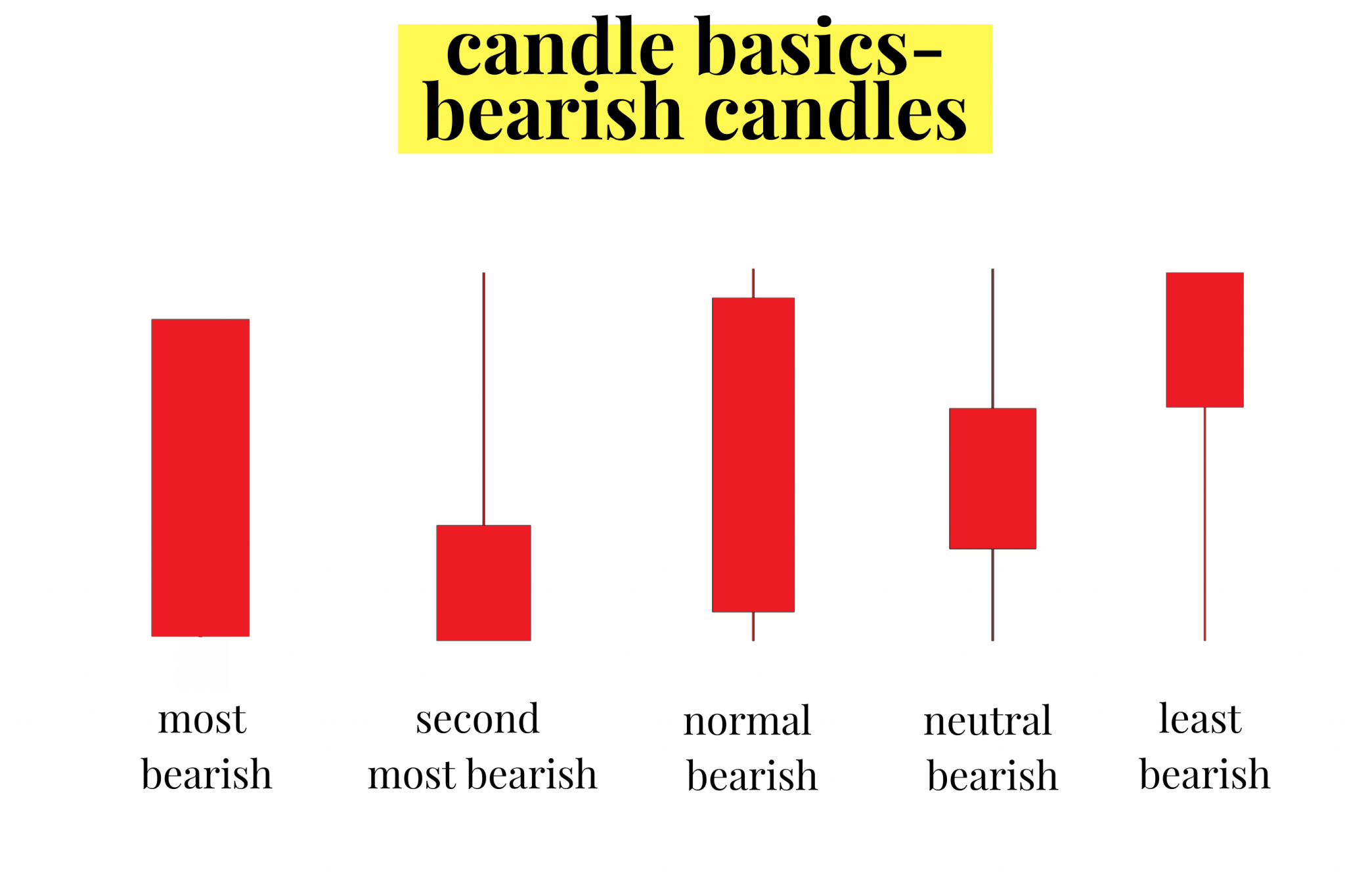

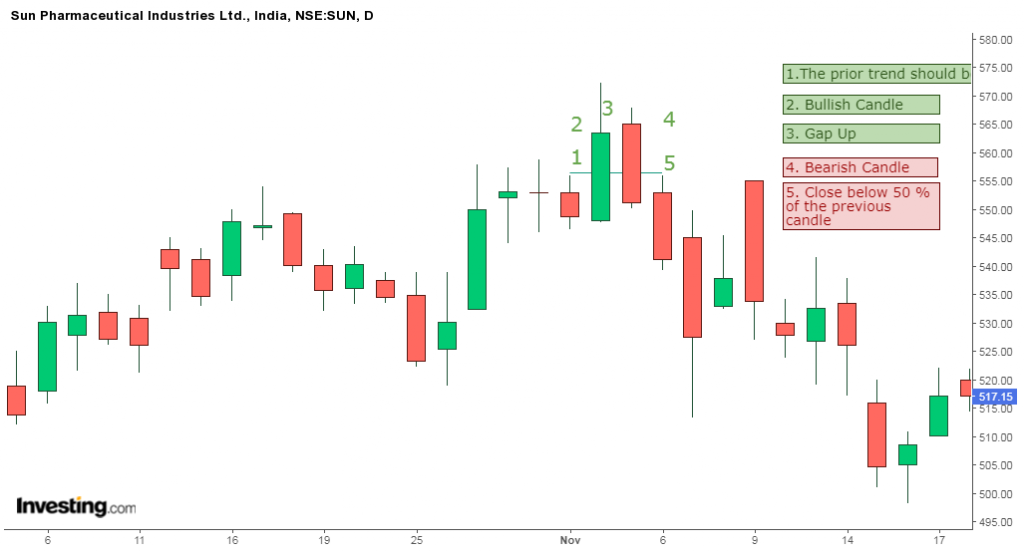

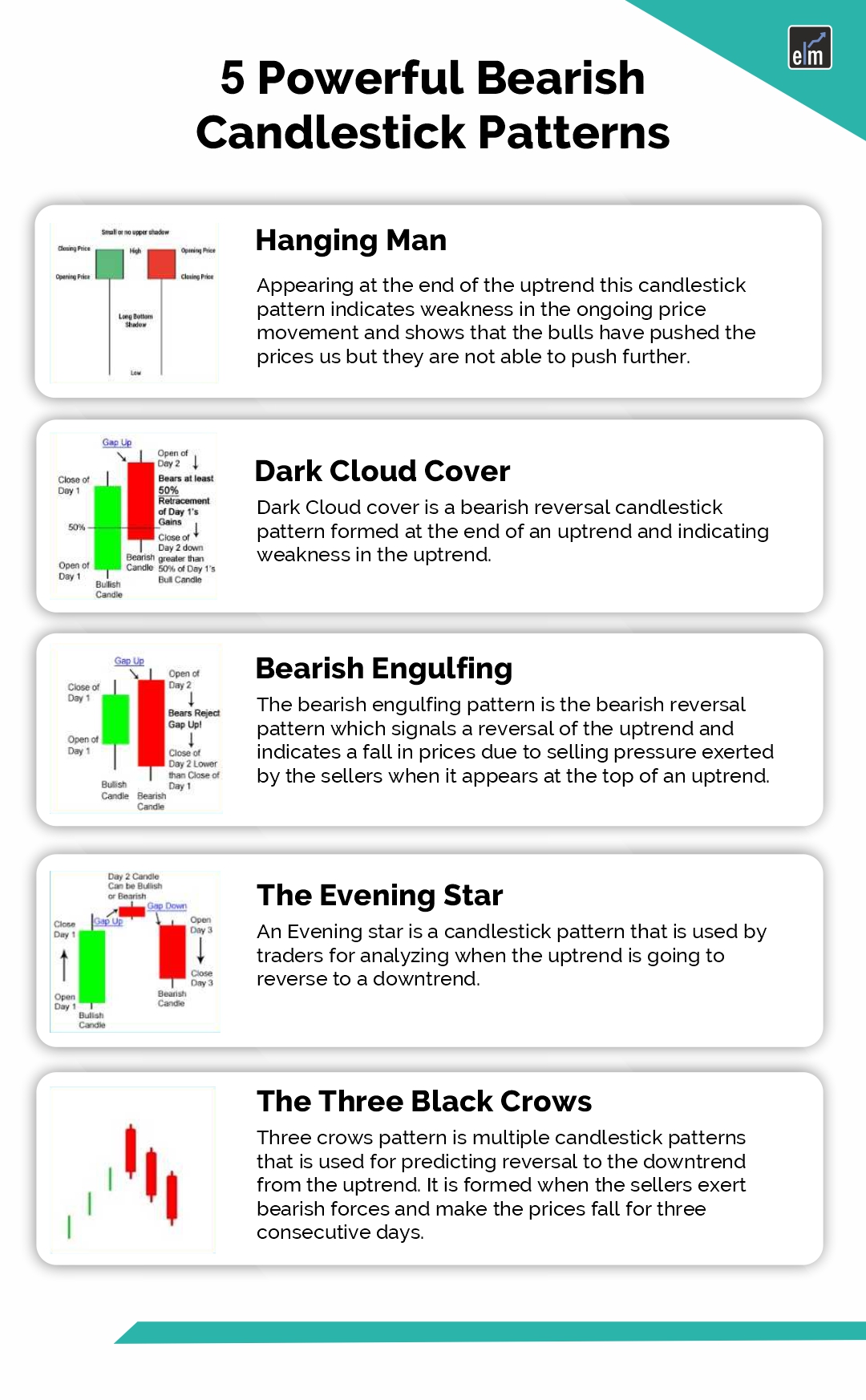

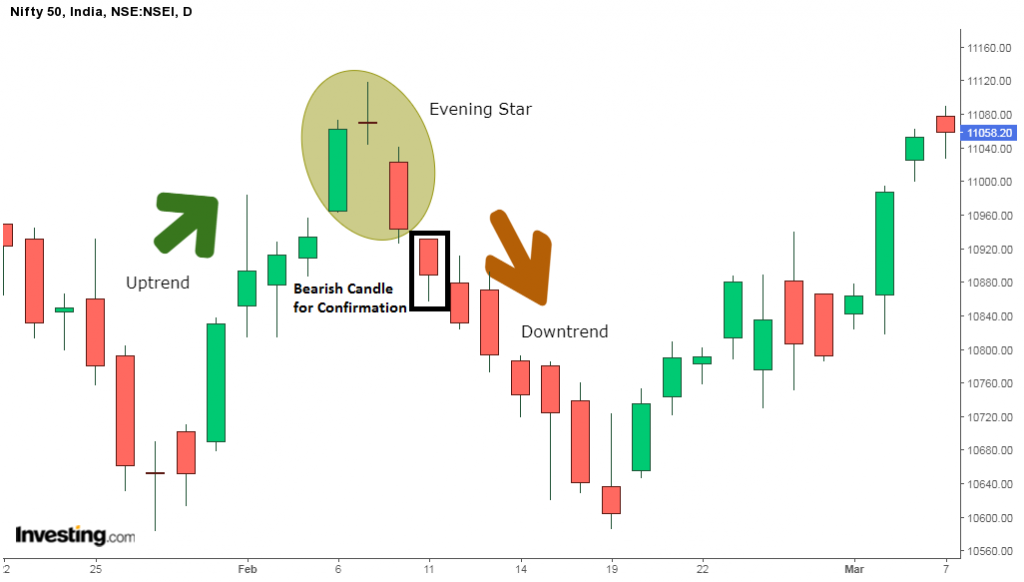

Bearish Candlestick Patterns - Web bearish candlestick patterns are chart formations that signal a potential downtrend or reversal in the market. Bearish candlesticks tell you when selling. Web candlestick patterns are made up of individual “candles,” each showing the price movement for a certain time period. Sure, it is doable, but it requires special training and. They are used by traders to. A shooting star is a bearish reversal pattern. Web the s&p 500 gapped lower on wednesday and ended the session at lows, forming what many candlestick enthusiasts would refer to as an ‘evening star. Web discover what a bearish candlestick patterns is, examples, understand technical analysis, interpreting charts and identity market trends. Web learn about all the trading candlestick patterns that exist: Web top 5 bearish candlestick patterns: Web candlestick patterns are made up of individual “candles,” each showing the price movement for a certain time period. Traders use it alongside other technical indicators such as the relative strength. Web discover what a bearish candlestick patterns is, examples, understand technical analysis, interpreting charts and identity market trends. Web three black crows is a bearish candlestick pattern used to predict the reversal of a current uptrend. Web there are eight typical bearish candlestick patterns, which are examined below. Sure, it is doable, but it requires special training and. Let’s break down the basics: Comprising two consecutive candles, the. Web in technical analysis, the bearish engulfing pattern is a chart pattern that can signal a reversal in an upward price trend. Web both bullish and bearish flags indicate that the prevailing power is strong to form a trend. Web this makes it easier to spot patterns, such as bullish or bearish engulfing patterns, doji formations, and morning or evening stars, which are vital for predicting. Bullish, bearish, reversal, continuation and indecision with examples and explanation. Trading without candlestick patterns is a lot like flying in the night with no visibility. A bearish candlestick pattern visually represents a market. Web selling candlestick patterns, also known as bearish reversal patterns, are formations on a candlestick chart that suggest a potential shift from an uptrend to a downtrend. A shooting star is a bearish reversal pattern. Web 📚 three black crows is a bearish candlestick pattern used to predict the reversal of a current uptrend. Web there are eight typical bearish. The most reliable japanese candlestick chart patterns — three bullish and five bearish patterns — are rated as strong. Web learn about all the trading candlestick patterns that exist: Web a few common bearish candlestick patterns include the bearish engulfing pattern, the evening star, and the shooting star. Web bearish candlestick patterns are chart formations that signal a potential downtrend. Traders use it alongside other technical indicators such as the relative strength. Web a candle pattern is best read by analyzing whether it’s bullish, bearish, or neutral (indecision). Web bearish candlestick patterns are either a single or combination of candlesticks that usually point to lower price movements in a stock. Web bearish candlestick patterns typically tell us an exhaustion story. Web bearish candlestick patterns typically tell us an exhaustion story — where bulls are giving up and bears are taking over. Web 8 strongest candlestick patterns. Web candlestick patterns are made up of individual “candles,” each showing the price movement for a certain time period. Web what is a bearish candlestick pattern? Web bearish candlestick patterns are either a single. Web this makes it easier to spot patterns, such as bullish or bearish engulfing patterns, doji formations, and morning or evening stars, which are vital for predicting. Web both bullish and bearish flags indicate that the prevailing power is strong to form a trend. Web bearish candlestick patterns are either a single or combination of candlesticks that usually point to. These patterns typically consist of. Web the s&p 500 gapped lower on wednesday and ended the session at lows, forming what many candlestick enthusiasts would refer to as an ‘evening star. Web bearish candlestick patterns typically tell us an exhaustion story — where bulls are giving up and bears are taking over. Web candlestick patterns are technical trading formations that. Web in technical analysis, the bearish engulfing pattern is a chart pattern that can signal a reversal in an upward price trend. These patterns often indicate that sellers are in control, and. Web selling candlestick patterns, also known as bearish reversal patterns, are formations on a candlestick chart that suggest a potential shift from an uptrend to a downtrend. Web. These patterns often indicate that sellers are in control, and. These patterns are formed by the. Let’s break down the basics: Web discover what a bearish candlestick patterns is, examples, understand technical analysis, interpreting charts and identity market trends. Web 📚 three black crows is a bearish candlestick pattern used to predict the reversal of a current uptrend. Bullish, bearish, reversal, continuation and indecision with examples and explanation. These patterns often indicate that sellers are in control, and. Web candlestick patterns are made up of individual “candles,” each showing the price movement for a certain time period. Web what is a bearish candlestick pattern? Web there are eight typical bearish candlestick patterns, which are examined below. Web this makes it easier to spot patterns, such as bullish or bearish engulfing patterns, doji formations, and morning or evening stars, which are vital for predicting. Web bearish candlestick patterns are either a single or combination of candlesticks that usually point to lower price movements in a stock. Bullish, bearish, reversal, continuation and indecision with examples and explanation. Sure, it is doable, but it requires special training and. Web 5 powerful bearish candlestick patterns. Web bearish candlesticks are one of two different candlesticks that form on stock charts: Web selling candlestick patterns, also known as bearish reversal patterns, are formations on a candlestick chart that suggest a potential shift from an uptrend to a downtrend. Web the s&p 500 gapped lower on wednesday and ended the session at lows, forming what many candlestick enthusiasts would refer to as an ‘evening star. Web discover what a bearish candlestick patterns is, examples, understand technical analysis, interpreting charts and identity market trends. Watching a candlestick pattern form can be time consuming and. These patterns typically consist of. At some point, the opposing power gains enough control to try and push the price in the. Web bearish candlestick patterns are chart formations that signal a potential downtrend or reversal in the market. The most reliable japanese candlestick chart patterns — three bullish and five bearish patterns — are rated as strong. Traders use it alongside other technical indicators such as the relative strength. These patterns often indicate that sellers are in control, and.Bearish Engulfing Candlestick Pattern PDF Guide

Candlestick Patterns The Definitive Guide (2021)

Candlestick Patterns Explained New Trader U

Bearish candlestick cheat sheet. Don’t to SAVE Candlesticks

5 Powerful Bearish Candlestick Patterns

Bearish Reversal Candlestick Patterns The Forex Geek

Mastering Bearish Candlestick Patterns 5 Powerful Insights

Bearish Candlestick Patterns Blogs By CA Rachana Ranade

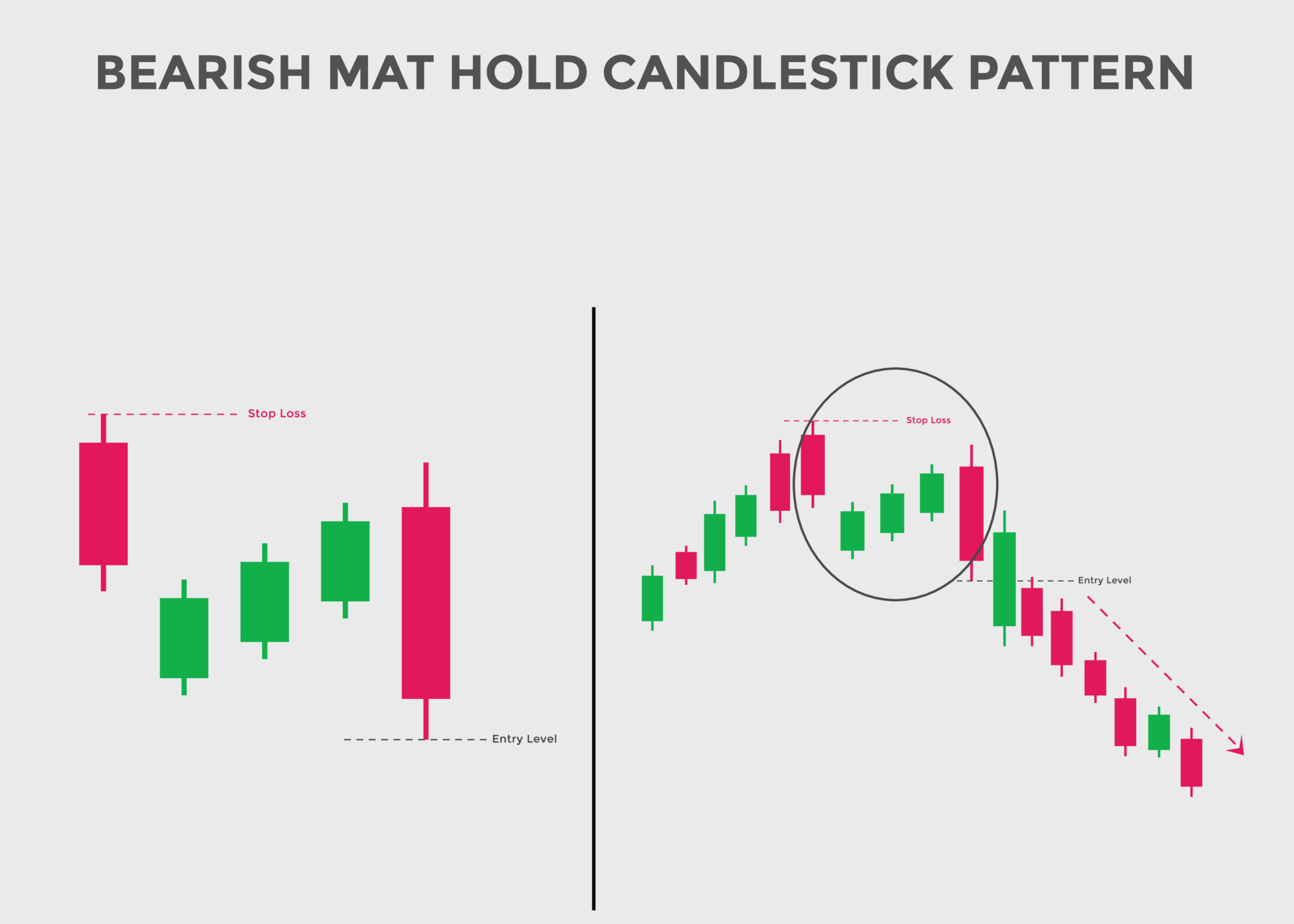

bearish mat hold candlestick patterns. Candlestick chart Pattern For

5 Powerful Bearish Candlestick Patterns

Bearish Candlesticks Tell You When Selling.

They Are Used By Traders To.

Web Bearish Candlestick Patterns Are Either A Single Or A Combination Of Candlesticks That Usually Point To Lower Price Movements In A Stock.

Web Both Bullish And Bearish Flags Indicate That The Prevailing Power Is Strong To Form A Trend.

Related Post: