M Trading Pattern

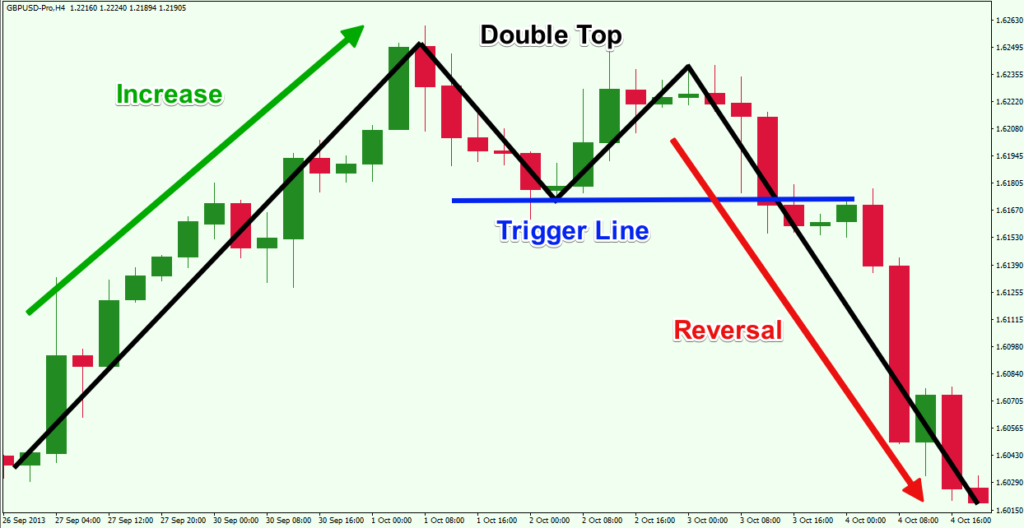

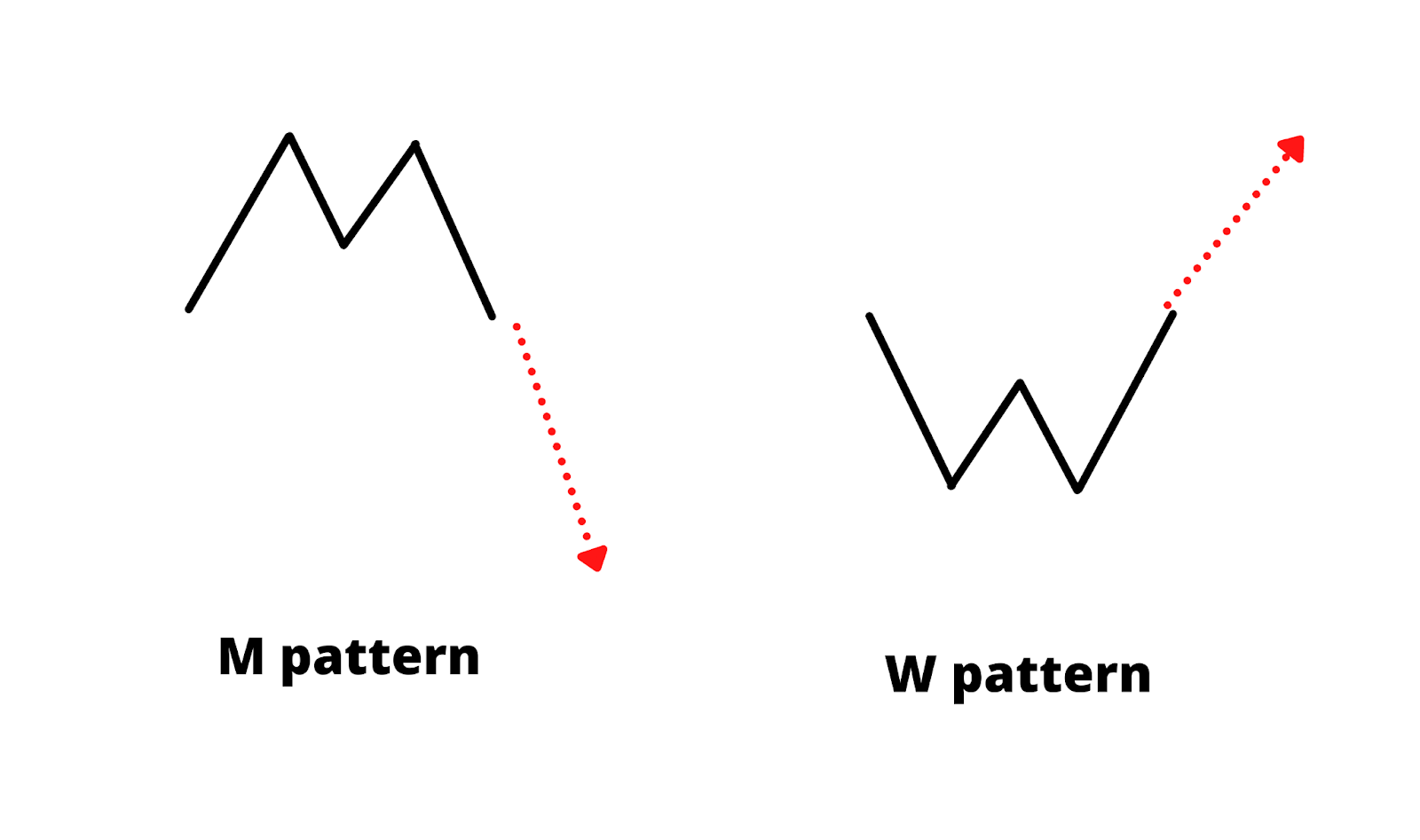

M Trading Pattern - Web the m pattern, also known as a double top, is a bearish reversal pattern that typically signals the end of an uptrend and the beginning of a downtrend. Web pattern.pedia on july 18, 2024: Web the m trading pattern, often referred to as a double top pattern, is a technical indicator recognized as a bearish reversal signal. It indicates a potential reversal in an upward trend, signaling a. Web wti crude oil (usoil): Web the m trading pattern forms when the price makes two upward moves, followed by a downward correction that retraces a significant portion of the prior rise. Web big m is a double top chart pattern with tall sides. Web using charts, technical analysts seek to identify price patterns and market trends in financial markets and attempt to exploit those patterns. Web chart patterns cheat sheet is an essential tool for every trader who is keen to make trading decisions by identifying repetitive patterns in the market. Web m formation, or double top, is a bearish reversal pattern that occurs when the price retests the same high and fails to break out. Web pattern.pedia on july 18, 2024: Web in this comprehensive guide, we delve into the highly effective m pattern trading strategy, equipping traders with valuable insights and techniques to navigate the. Find out the characteristics, variations, and strategies of this. Learn how to detect, confirm, and. It is characterized by its ‘m’ shape,. Web the m trading pattern forms when the price makes two upward moves, followed by a downward correction that retraces a significant portion of the prior rise. Web using charts, technical analysts seek to identify price patterns and market trends in financial markets and attempt to exploit those patterns. Web research shows that the most reliable chart patterns are the head and shoulders, with an 89% success rate, the double bottom (88%), and the triple bottom. It indicates a potential reversal in an upward trend, signaling a. Web trading arthur merrill's m and w patterns: Web explore the top 11 trading chart patterns every trader needs to know and learn how to use them to enter and exit trades. Understanding this pattern can help traders anticipate potential. This pattern is formed with two peaks above a support level which is. Web the m trading pattern, often referred to as a double top pattern, is a. Web everything about m and w pattern trading with a complete strategy. Article provides identification guidelines and trading tactics by internationally known author and trader thomas. Web the master pattern indicator is derived from the framework proposed by wyckoff and automatically displays major/minor patterns and their associated expansion lines on the. Web the m trading pattern, often referred to as. Learn how to detect, confirm, and. Web the m pattern, also known as a double top, is a bearish reversal pattern that typically signals the end of an uptrend and the beginning of a downtrend. Web the m trading pattern is a technical analysis formation that resembles the letter “m” on a price chart. This pattern is formed with two. Web explore the top 11 trading chart patterns every trader needs to know and learn how to use them to enter and exit trades. Web the m trading pattern, often referred to as a double top pattern, is a technical indicator recognized as a bearish reversal signal. Web pattern.pedia on july 18, 2024: Web big m is a double top. This pattern is formed with two peaks above a support level which is. Web the m trading pattern, often referred to as a double top pattern, is a technical indicator recognized as a bearish reversal signal. Web learn what m pattern trading is, how to spot it on charts, and how to use it to predict price movements. Web traders,. Web learn what m pattern trading is, how to spot it on charts, and how to use it to predict price movements. Web the m trading pattern, often referred to as a double top pattern, is a technical indicator recognized as a bearish reversal signal. Web wti crude oil (usoil): Web explore the top 11 trading chart patterns every trader. When you analyze trading charts, you’ll see certain. Downside price pressures have been in play for this energy commodity, as. Find out the characteristics, variations, and strategies of this. Learn how to detect, confirm, and. Web research shows that the most reliable chart patterns are the head and shoulders, with an 89% success rate, the double bottom (88%), and the. Web in this comprehensive guide, we delve into the highly effective m pattern trading strategy, equipping traders with valuable insights and techniques to navigate the. Web the m pattern, also known as the double top, indicates a bearish reversal, suggesting that a current uptrend may reverse into a downtrend. It indicates a potential reversal in an upward trend, signaling a.. Web trading arthur merrill's m and w patterns: Web explore the top 11 trading chart patterns every trader needs to know and learn how to use them to enter and exit trades. Web learn what m pattern trading is, how to spot it on charts, and how to use it to predict price movements. Downside price pressures have been in. Web m formation, or double top, is a bearish reversal pattern that occurs when the price retests the same high and fails to break out. Web one of the most common chart patterns is the m pattern, also known as the double top pattern. Downside price pressures have been in play for this energy commodity, as. Web pattern.pedia on july. Learn under two minutes including stops, targets and entry points. Web one of the most common chart patterns is the m pattern, also known as the double top pattern. Web everything about m and w pattern trading with a complete strategy. This pattern is formed with two peaks above a support level which is. Understanding this pattern can help traders anticipate potential. Downside price pressures have been in play for this energy commodity, as. Web the m trading pattern, often referred to as a double top pattern, is a technical indicator recognized as a bearish reversal signal. When you analyze trading charts, you’ll see certain. Web using charts, technical analysts seek to identify price patterns and market trends in financial markets and attempt to exploit those patterns. Web the m pattern, also known as a double top, is a bearish reversal pattern that typically signals the end of an uptrend and the beginning of a downtrend. Web the m trading pattern is a technical analysis formation that resembles the letter “m” on a price chart. Web in the financial markets, the pattern forms after a bullish trend when a currency pair reaches two consecutive peaks, creating the shape of the “m” letter. Web explore the top 11 trading chart patterns every trader needs to know and learn how to use them to enter and exit trades. Web in this comprehensive guide, we delve into the highly effective m pattern trading strategy, equipping traders with valuable insights and techniques to navigate the. It is characterized by its ‘m’ shape,. Web traders, in this trading tutorial video, i go through some of the secrets of trading w and m patterns.M Forex Pattern Fast Scalping Forex Hedge Fund

W Pattern Trading vs. M Pattern Strategy Choose One or Use Both? • FX

The Complete Guide to Technical Analysis Price Patterns. Stock chart

Classic Chart Patterns

M Chart Pattern New Trader U

Technical Analysis Series — Article 3 Introduction to Pattern Trading

Pattern Trading Unveiled Exploring M and W Pattern Trading

Ultimate Chart Patterns Trading Course (EXPERT INSTANTLY) Forex Position

What are the patterns of "M" and "W"? for BINANCEBTCUSDT by

Chart Patterns Trading Charts Chart Patterns Stock Chart Patterns Images

Web The Master Pattern Indicator Is Derived From The Framework Proposed By Wyckoff And Automatically Displays Major/Minor Patterns And Their Associated Expansion Lines On The.

Web The M Trading Pattern Forms When The Price Makes Two Upward Moves, Followed By A Downward Correction That Retraces A Significant Portion Of The Prior Rise.

Web Chart Patterns Cheat Sheet Is An Essential Tool For Every Trader Who Is Keen To Make Trading Decisions By Identifying Repetitive Patterns In The Market.

Find Out The Characteristics, Variations, And Strategies Of This.

Related Post: