Morning Star Pattern Candlestick

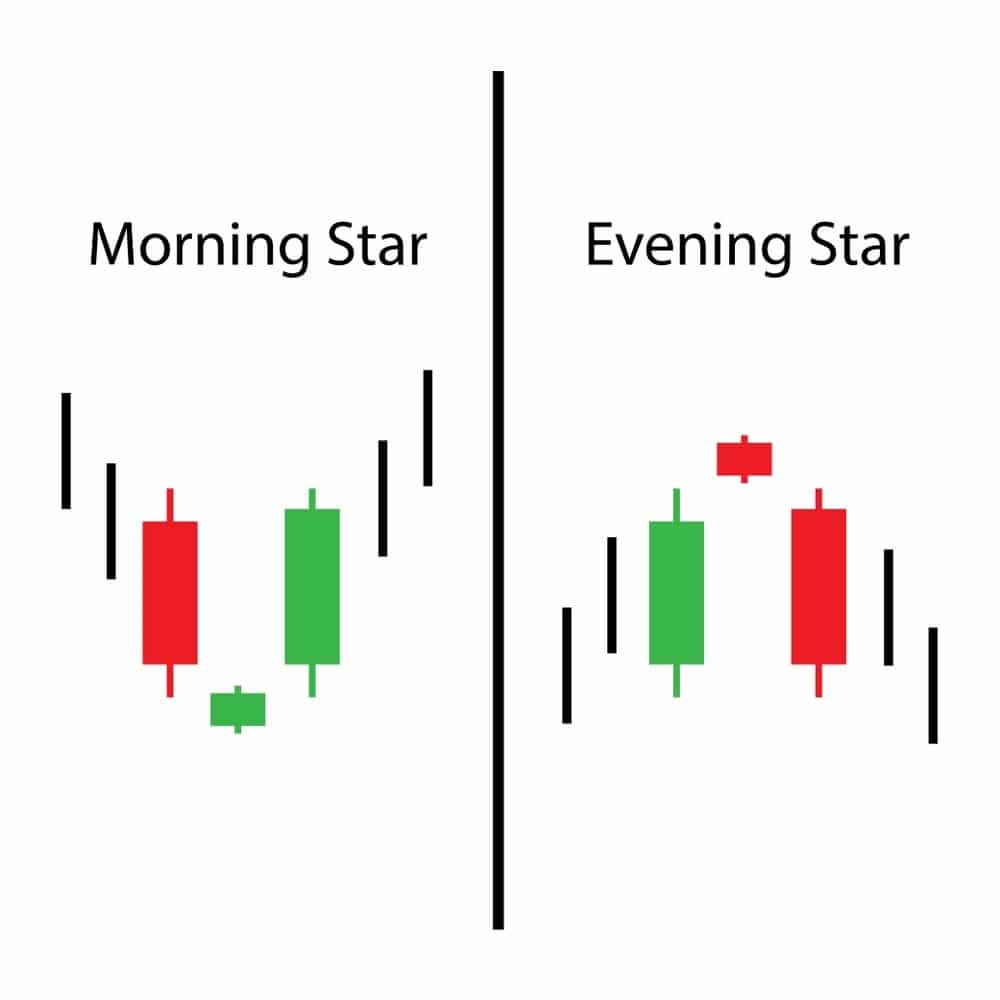

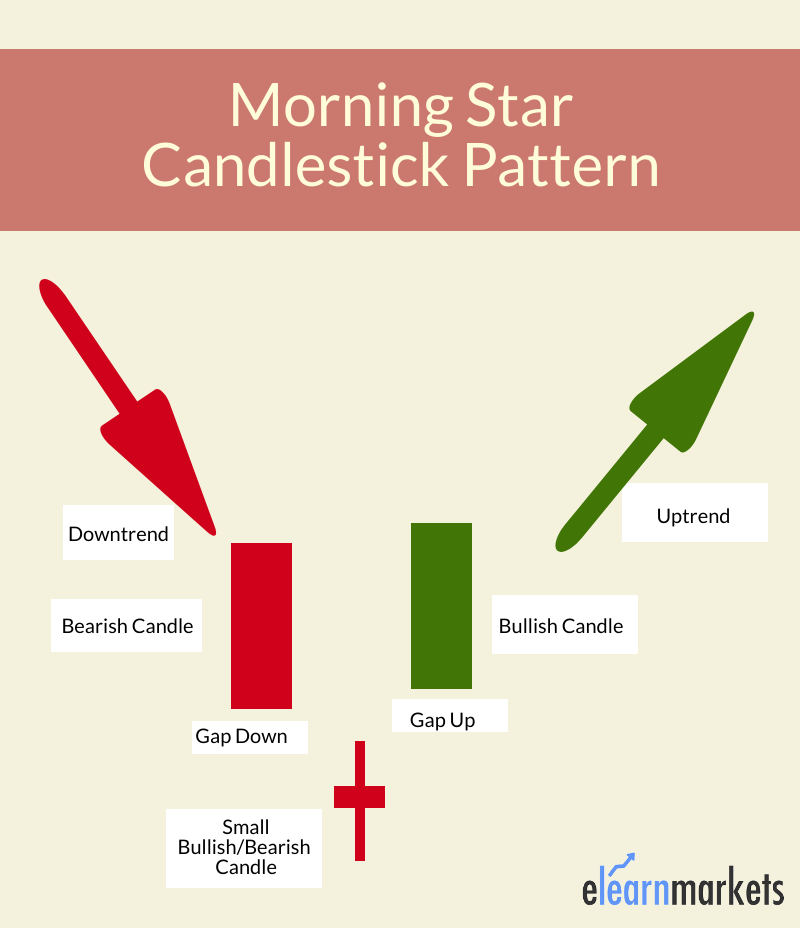

Morning Star Pattern Candlestick - Web the morning star is a pattern seen in a candlestick chart, a popular type of a chart used by technical analysts to anticipate or predict price action of a security, derivative, or currency over a short period of time. Web the morning star is a candlestick with a small body that forms at the bottom of the downtrend and signals an upward trend reversal. Web the morning star bullish candlestick pattern is a valuable asset for traders seeking to identify potential trend reversals and capitalize on bullish opportunities. The morning star can also occur without a body. Web the morning star candlestick pattern is easily recognizable on a chart since it consists of three different candlesticks. Web <<strong>strong</strong>>cosmic patterns convergence 2025</strong>. Web bullish candlesticks indicate an upward trend and buying pressure, while bearish candlesticks signal a downward trend and selling pressure. It is considered a reversal pattern that calls for a price increase following a sustained downward trend. The first candlestick is a long bearish candlestick, followed by a small bullish or bearish candlestick, and finally, a long bullish candlestick. It consists of a bearish candle, a short doji that gaps down, and a bullish candle that gaps up, signaling a potential reversal from a bearish to a bullish trend. This pattern is composed of three candlesticks, with the first one being a tall bearish candle. Since the days of the treadway commission, and enforcement cases before it, we have preached the importance of this tone from the top. Oil and gas giant conocophillips ( cop) appears to be forming a morning star pattern. The morning star can also occur without a body. A completed morning star formation indicates a new bullish sentiment in the market. Web the morning star is a candlestick with a small body that forms at the bottom of the downtrend and signals an upward trend reversal. This candlestick formation may symbolize. Many other combinations of candlesticks make up valuable patterns, and i encourage seeking them out on your charts to help understand the stories they are telling you! Web a morning star is a visual pattern made up of a tall black candlestick, a smaller black or white candlestick with a short body and long wicks, and a third tall white candlestick. Using candlestick patterns with key areas of value—such as support and resistance levels, trendlines, and moving. It consists of a bearish candle, a short doji that gaps down, and a bullish candle that gaps up, signaling a potential reversal from a bearish to a bullish trend. The morning star candlestick forms at the bottom of a stock’s price decline and suggests a downtrend may be nearing its end. Web what is a morning star candlestick pattern?. Web the morning star candlestick pattern is easily recognizable on a chart since it consists of three different candlesticks. It is a subtype of the star pattern and the opposite of the evening star. Web morning and evening star reversal patterns: The pattern consists of three candlesticks: Web <<strong>strong</strong>>cosmic patterns convergence 2025</strong>. Web the morning star is a candlestick pattern that is comprised of three candles. Web a morning star pattern consists of three candlesticks that form near support levels. The first line is any black candle appearing as a long line in an uptrend: It is a subtype of the star pattern and the opposite of the evening star. Web morning. A completed morning star formation indicates a new bullish sentiment in the market. Web the morning star is a reversal candlestick pattern that signals a potential trend change from downside to upside movement. New paint outside of house, beautiful two story 5 bedroom 4 full bath home w/ two master suites one located on the first floor and the other. Web the morning star candlestick pattern is easily recognizable on a chart since it consists of three different candlesticks. This pattern is composed of three candlesticks, with the first one being a tall bearish candle. Oil and gas giant conocophillips ( cop) appears to be forming a morning star pattern. Long black candle, black candle, black marubozu, opening black marubozu,. Web a morning star pattern consists of three candlesticks that form near support levels. It may appear during a downtrend and is made up of a large bearish candle followed by a short candle and a large bullish candle. It is formed at the bottom of a downtrend and it gives us a warning sign that the ongoing downtrend is. A completed morning star formation indicates a new bullish sentiment in the market. Web the morning star is a pattern seen in a candlestick chart, a popular type of a chart used by technical analysts to anticipate or predict price action of a security, derivative, or currency over a short period of time. Web a morning star pattern consists of. Web the morning star candlestick pattern is easily recognizable on a chart since it consists of three different candlesticks. Oil and gas giant conocophillips ( cop) appears to be forming a morning star pattern. It consists of a bearish candle, a short doji that gaps down, and a bullish candle that gaps up, signaling a potential reversal from a bearish. The first candlestick is a long bearish candlestick, followed by a small bullish or bearish candlestick, and finally, a long bullish candlestick. Web <<strong>strong</strong>>cosmic patterns convergence 2025</strong>. Web the morning star is a candlestick pattern that is comprised of three candles. Web bullish candlesticks indicate an upward trend and buying pressure, while bearish candlesticks signal a downward trend and selling. Short sale has been approved by the bank, pool/spa home! The first candlestick is a long bearish candlestick, followed by a small bullish or bearish candlestick, and finally, a long bullish candlestick. A completed morning star formation indicates a new bullish sentiment in the market. Web the morning star is a reversal candlestick pattern that signals a potential trend change. Many other combinations of candlesticks make up valuable patterns, and i encourage seeking them out on your charts to help understand the stories they are telling you! Two large ones with different directions and a smaller candlestick between them. This candlestick formation may symbolize. Morning star candlestick pattern illustration. Using candlestick patterns with key areas of value—such as support and resistance levels, trendlines, and moving. Web morning and evening star reversal patterns: Oil and gas giant conocophillips ( cop) appears to be forming a morning star pattern. Short sale has been approved by the bank, pool/spa home! The first candlestick is a long bearish candlestick, followed by a small bullish or bearish candlestick, and finally, a long bullish candlestick. It is considered a reversal pattern that calls for a price increase following a sustained downward trend. Web the morning star is a candlestick with a small body that forms at the bottom of the downtrend and signals an upward trend reversal. Web a morning star is a bullish visual pattern in technical analysis with three candlesticks. The morning star candlestick forms at the bottom of a stock’s price decline and suggests a downtrend may be nearing its end. It may appear during a downtrend and is made up of a large bearish candle followed by a short candle and a large bullish candle. The morning star can also occur without a body. A completed morning star formation indicates a new bullish sentiment in the market.Morning Star Candlestick Pattern

Understanding The Morning Star Candlestick Pattern InvestoPower

Morning Star Candle Stick Pattern

What Is Morning Star Candlestick? Formation & Uses ELM

A Tutorial On The Morning Star Candlestick Pattern Forex Training Group

How To Trade Blog What Is Morning Star Candlestick Pattern? How To Use

Morning Star Candlestick A Forex Trader’s Guide

Morning Star Candlestick Pattern definition and guide

Best candlestick patterns morning star candlestick pattern

Morning Star Candlestick Pattern How to Identify Perfect Morning Star

The First Candlestick Drops With A Gap Down, Followed By The Third Candlestick, Which Is Followed By A Gap Up To The Third And Final Candlestick Of The Morning Star Index.

Web By Josh Enomoto, Investorplace Contributor Jul 9, 2024, 8:11 Am Edt.

It Consists Of A Bearish Candle, A Short Doji That Gaps Down, And A Bullish Candle That Gaps Up, Signaling A Potential Reversal From A Bearish To A Bullish Trend.

It Typically Forms After A Downward Trend, Telling Us It Is The Start Of An Upward Climb And Indicating A Reversal In The Previous Price Trend.

Related Post: